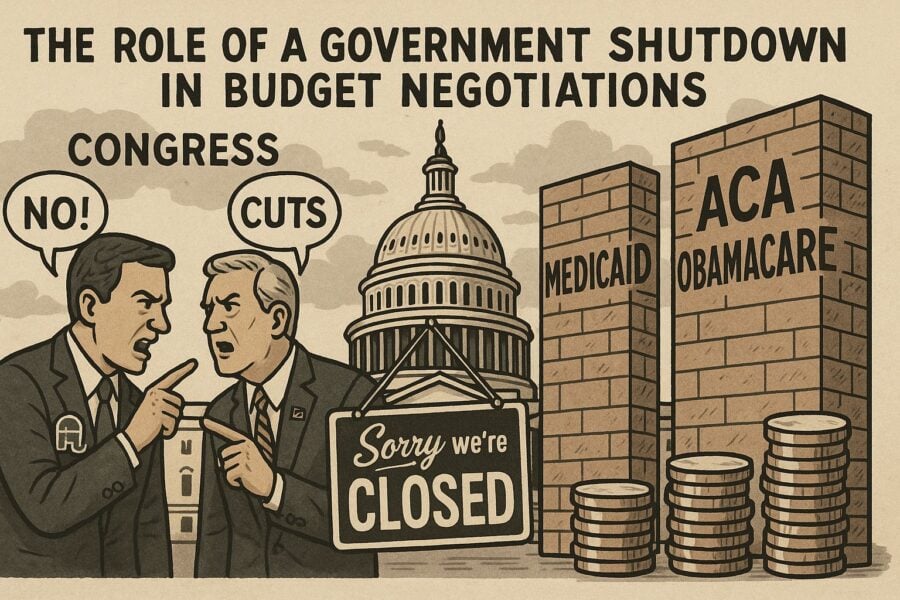

The government shutdown is mainly targeting the massive cuts in medical assistance for the poor and middle class. This is indirect but nevertheless the actual reason for the budget fight. It can be a bit, or more than a bit, confusing so I will attempt to explain what is happening.

Part of what is confusing is who is doing this. It is NOT President Trump, the actual fight is between the lawmakers in Congress.

Cause of Government Shutdown

A government shutdown happens when Congress fails to pass the necessary funding bills to keep government agencies running. This failure is almost always the result of a political standoff over a particular issue. In this case, the issue is often a policy rider — a provision attached to a spending bill — that one party wants and the other opposes.

Here’s a breakdown of how this standoff could prevent the tax cuts and Medicaid/Affordable Care Act (Obamacare which insures about 15 million poor) cuts:

The Leverage of a Shutdown

The party that wants to stop the tax and spending cuts can use the appropriations process as leverage. In this case the Democrats said to the Republicans in Congress: “We will not vote to fund the government unless you remove the specific provisions for tax cuts and Medicaid/ACA cuts from the budget.”

The Republicans refused, the funding bill failed, and the government shut down. Now both sides are under immense pressure. A prolonged shutdown can have significant negative effects on the economy and public opinion, which no one in Congress wants to be blamed for.

How It Prevents the Cuts

The political calculus is that the side pushing for the cuts might be forced to abandon them in order to end the shutdown. They may decide that keeping the government open is a higher priority than their policy goals.

The government shutdown doesn’t prevent tax cuts or spending cuts; the political fight that causes the shutdown does. The inability to agree on the funding of the government is used as a powerful tool to force one side to concede on other issues.

That is the strategic or long term goal.

The tactical or immediate result is that Medicare, Social Security, and Medicaid payments continue because they are required by laws which have not been repealed.

But under the Big Beautiful Bill passed earlier this year and signed by President Trump, the ACA which is for low income working people, and Medicaid for very poor people will see out of pocket or co-pay bills slightly more than double.

Increased ACA payments may be made retroactively even if they are not reinstated by November 1, but there is no guarantee and some people may fail to enroll in the ACA fearing the higher prices may stay in place all year.

President Trump also recently imposed 100+% increased tariffs on imported pharmaceuticals although he has suspended this for some.

Medical Services in The Firing Line

Telehealth or telephone office visits are a special Medicare service which will end. That includes people who are just discharged from the hospital after operations or serious illnesses.

All in all, if the Democrats are not able to get Republicans to compromise on the cuts to services for the poor and middle class, even leaving the massive tax cuts for big corporations and the very rich in place, citizens will see cuts of at least $1 trillion in Medicaid (for the poor) and ACA (for the middle/working class) funding.

Currently the top federal taxes for the richest is 37% (until the new tax rates go into effect), the marginal rate was 91% in the boom time of the 50s, with EFFECTIVE or real rates after regular deductions and exclusions of 26% and 42%.

Some people complain about the new $200 million White House ballroom but, as with many White House improvements by new Presidents, this is entirely privately funded, NOT TAXPAYER money.